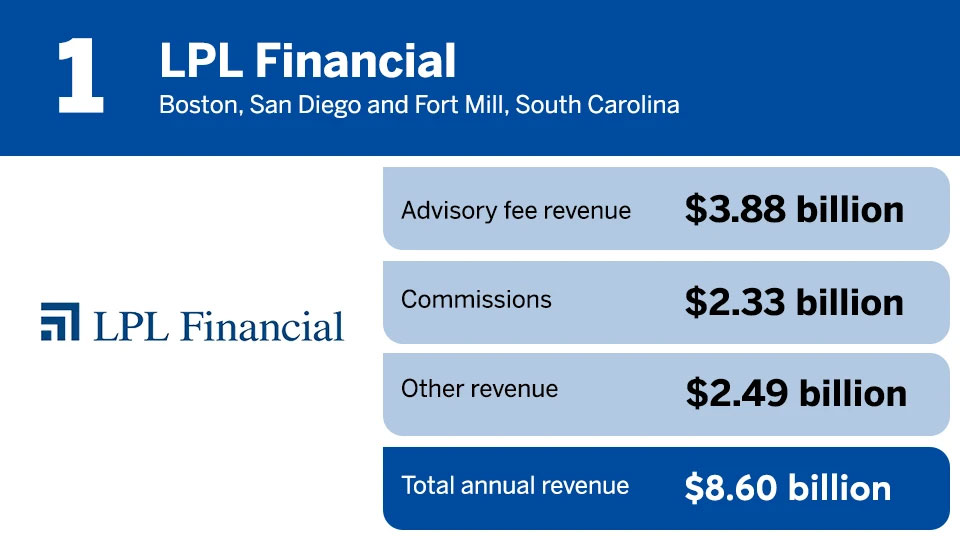

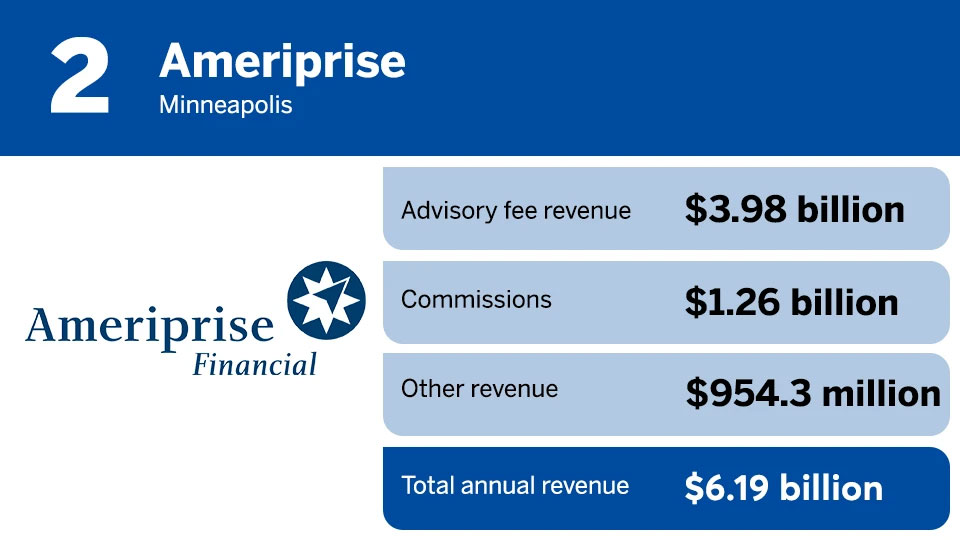

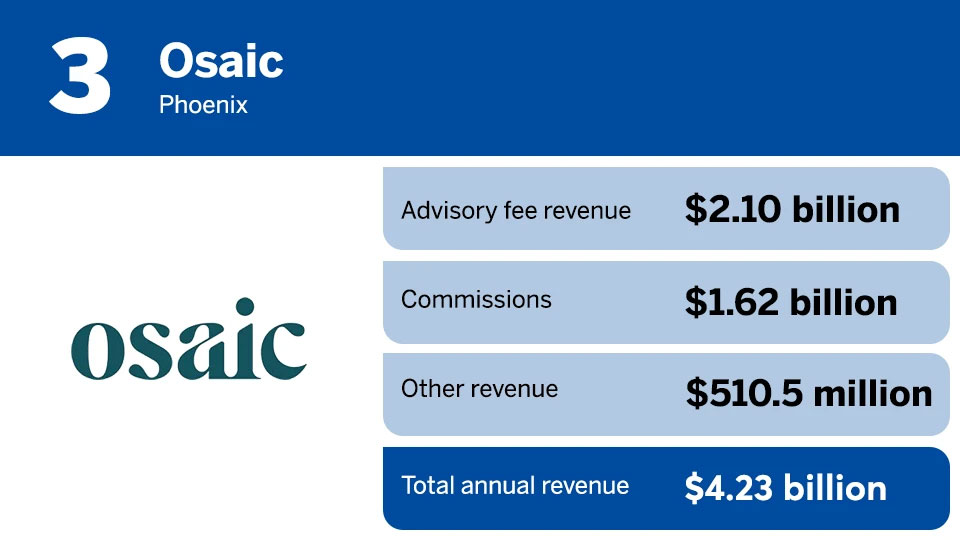

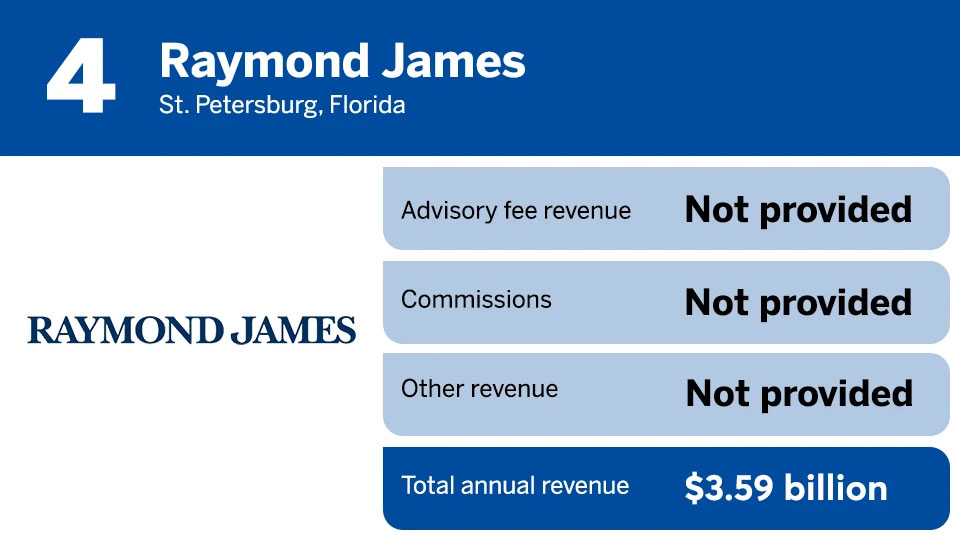

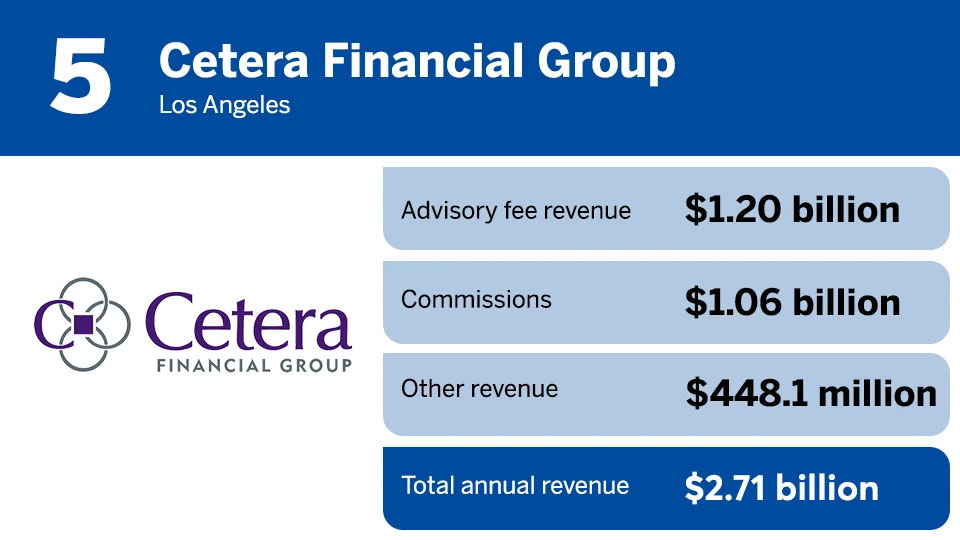

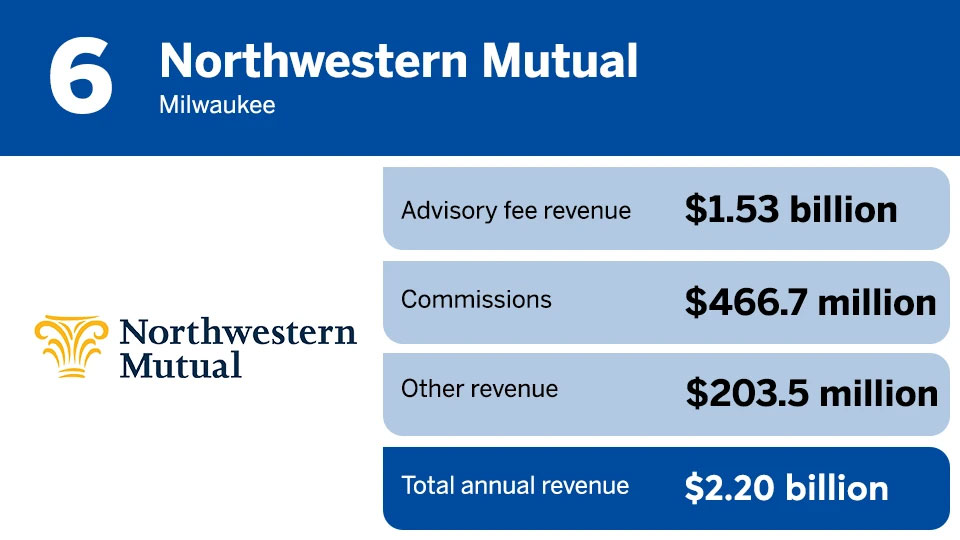

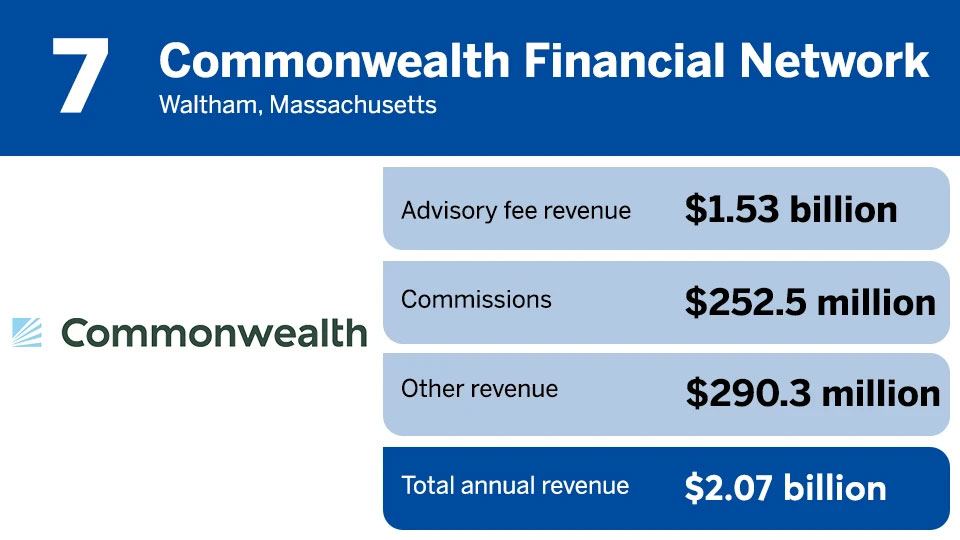

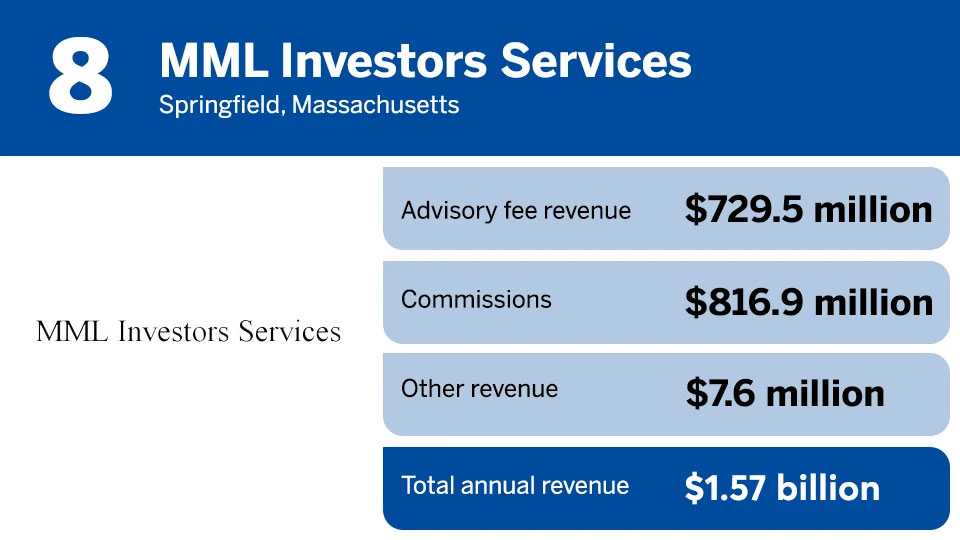

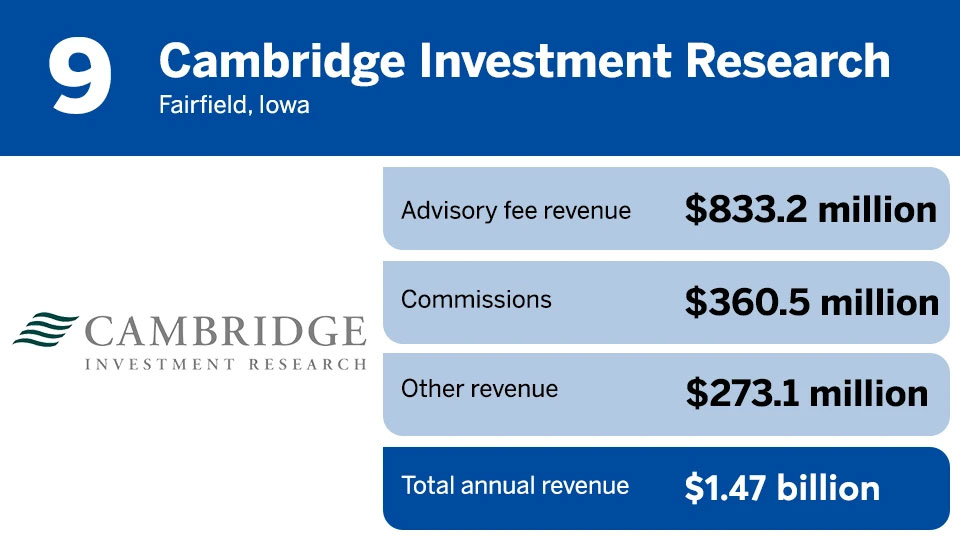

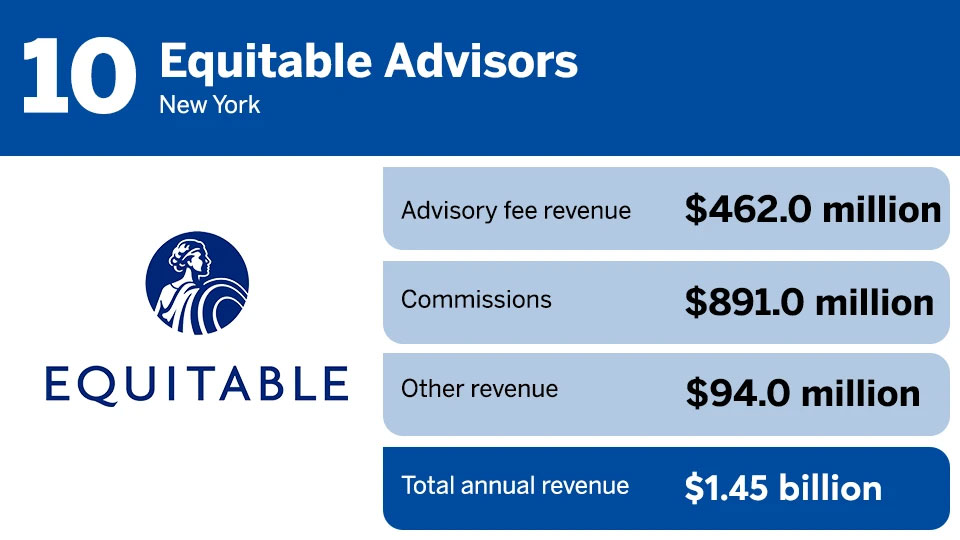

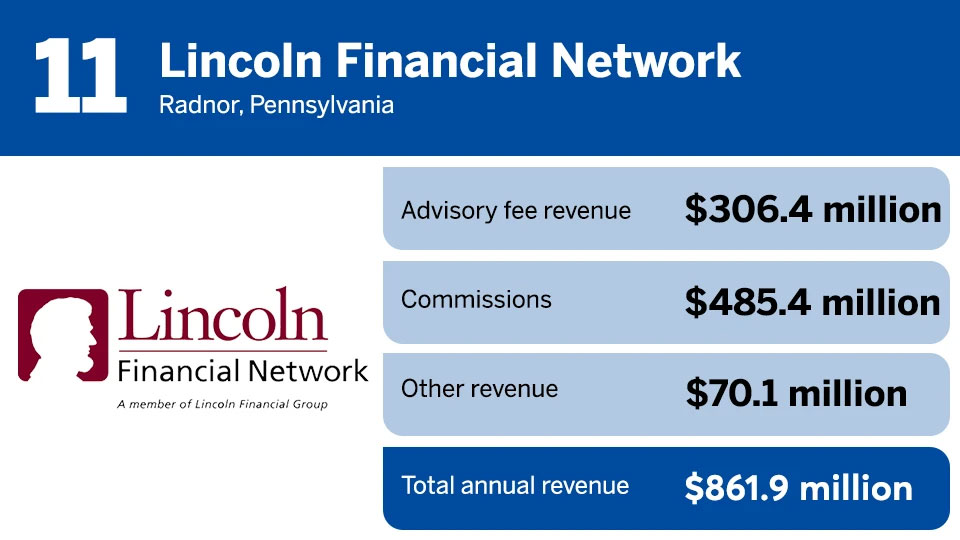

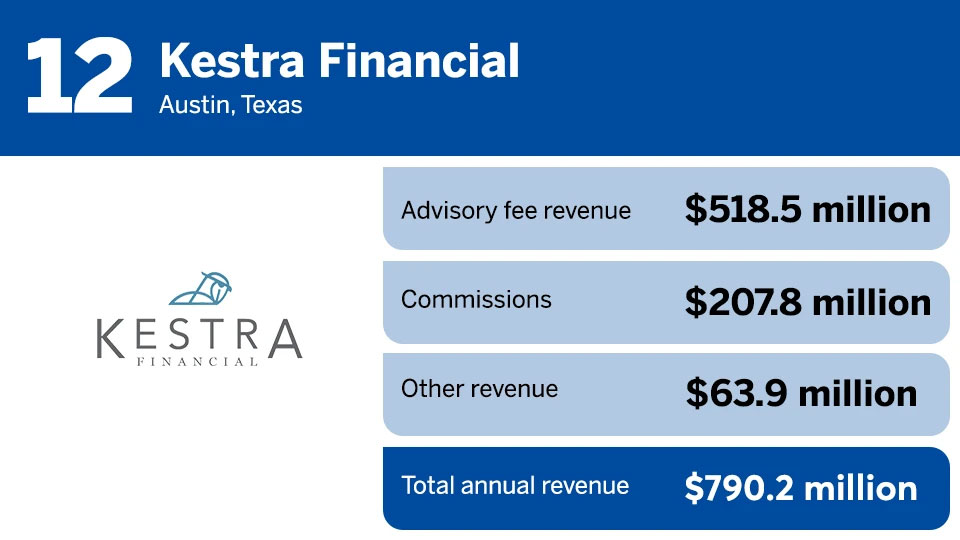

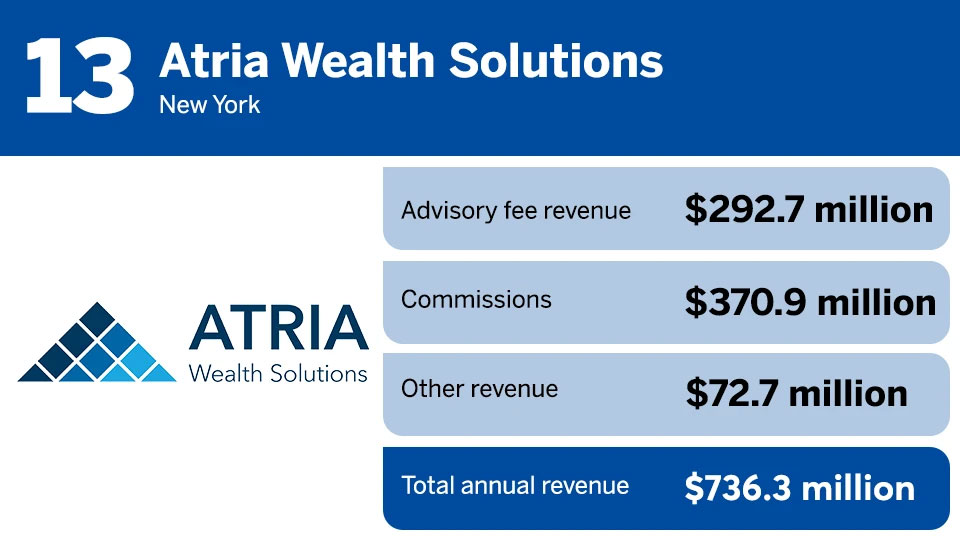

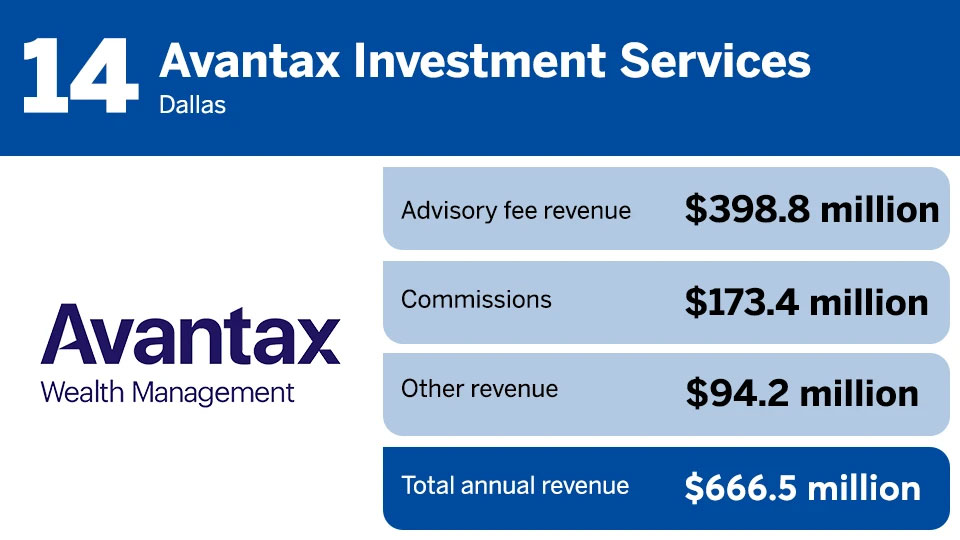

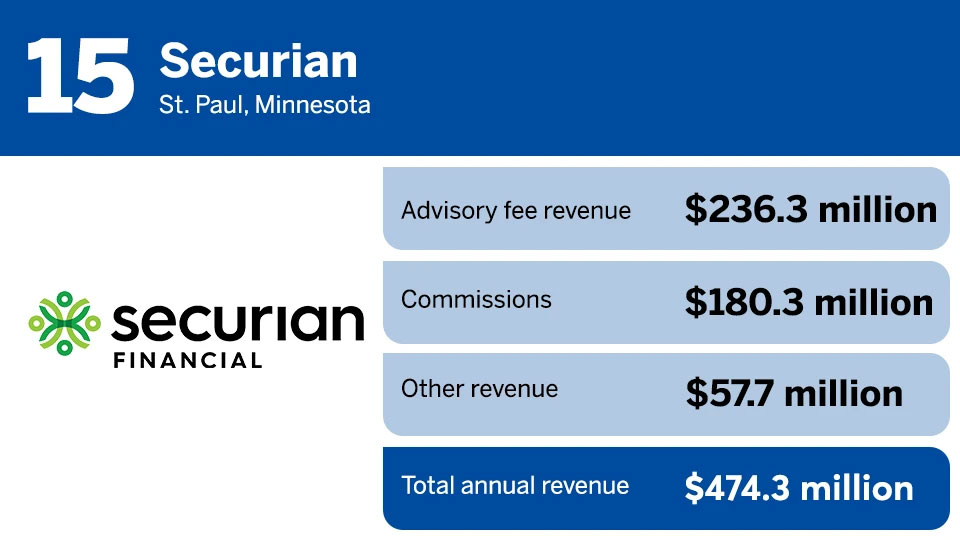

IBD Elite: The 15 Largest Independent Brokerages in Wealth Management

by Tobias Salinger | As seen on financial-planning.com

Independent wealth management firms are finding ways to keep growing — even in bad years for stock and bond values.

Despite the historically awful performance of stocks and bonds last year and the direct correlation with wealth management fees based on their earnings, the independent brokerages participating in Financial Planning’s 38th annual IBD Elite study reported that their businesses grew 6% in 2022 to a combined $41.13 billion in revenue. The slideshow below displays the 15 largest firms in the channel, with a half dozen expanding by double-digit percentages in 2022.

“The independent channel continues to grow significantly,” said Marianne Caswell, the president of Park Avenue Securities, a New York-based independent brokerage and registered investment advisory firm that’s a wholly-owned subsidiary of the Guardian Life Insurance Company of America. “The combination of holistic planning as well as seeing more advisors move into the independent space in the past several years I think is what has allowed the revenue to continue to grow.”

The past decade has seen Caswell’s firm of 2,400 financial advisors managing $47 billion in client assets change from “purely an accommodation business” revolving around insurance, annuities and turnkey investments to an “advisor-focused” business, she said in an interview last month. The shift to a more comprehensive wealth management company has led the firm to ramp up its technology, integrate more services and use specific fees for planning more widely.

The firm is striving to give its clients the “full picture” of their finances, rather than looking simply at their insurance or investments alone, Caswell said.

“They have to look at their protection. They have to look at their assets. They have to look at their liabilities. And then, today, they have to look at their cash flow,” she said.

Scroll down the slideshow to see the rankings of the 15 largest independent brokerages in wealth management by their annual revenue. Read the IBD Elite cover story, “What the heck is an OSJ?“. You can also browse all the data from this year’s survey in interactive format. And, for a look at the largest firms of last year’s IBD Elite, click here.

Notes: The companies are ranked below by their 2022 revenue, as reported by the firms themselves. FP relies on each firm to state their annual metrics accurately. The industry term “producing registered representative” refers to each firm’s most accurate count of financial advisors using the firm as their brokerage or RIA. “Other revenue” means any other business besides sales commissions and advisory fees. Each metric is as of year-end 2022.